The Nicklaus Companies, the golf empire named for one of golf’s biggest names, has filed for Chapter 11 bankruptcy protection.

Before we leave half-cocked, please note that this is not the case Jack Nicklaus filing bankruptcy. IS The Nicklaus Companiesthe house Jack built and ultimately destroyed after winning a $50 million lawsuit against the company he founded.

Sound confusing? Let’s see if we can clear it up a bit.

What is Nicklaus Companies?

of The Nicklaus Companies is a global business built on Jack’s name. It includes Nicklaus Design, one of the world’s largest golf estate architecture and development firms. Nicklaus Design has created more than 420 courses worldwide. The Nicklaus Companies also include lifestyle, marketing, licensing and golf equipment businesses under the Nicklaus and Golden Bear brands.

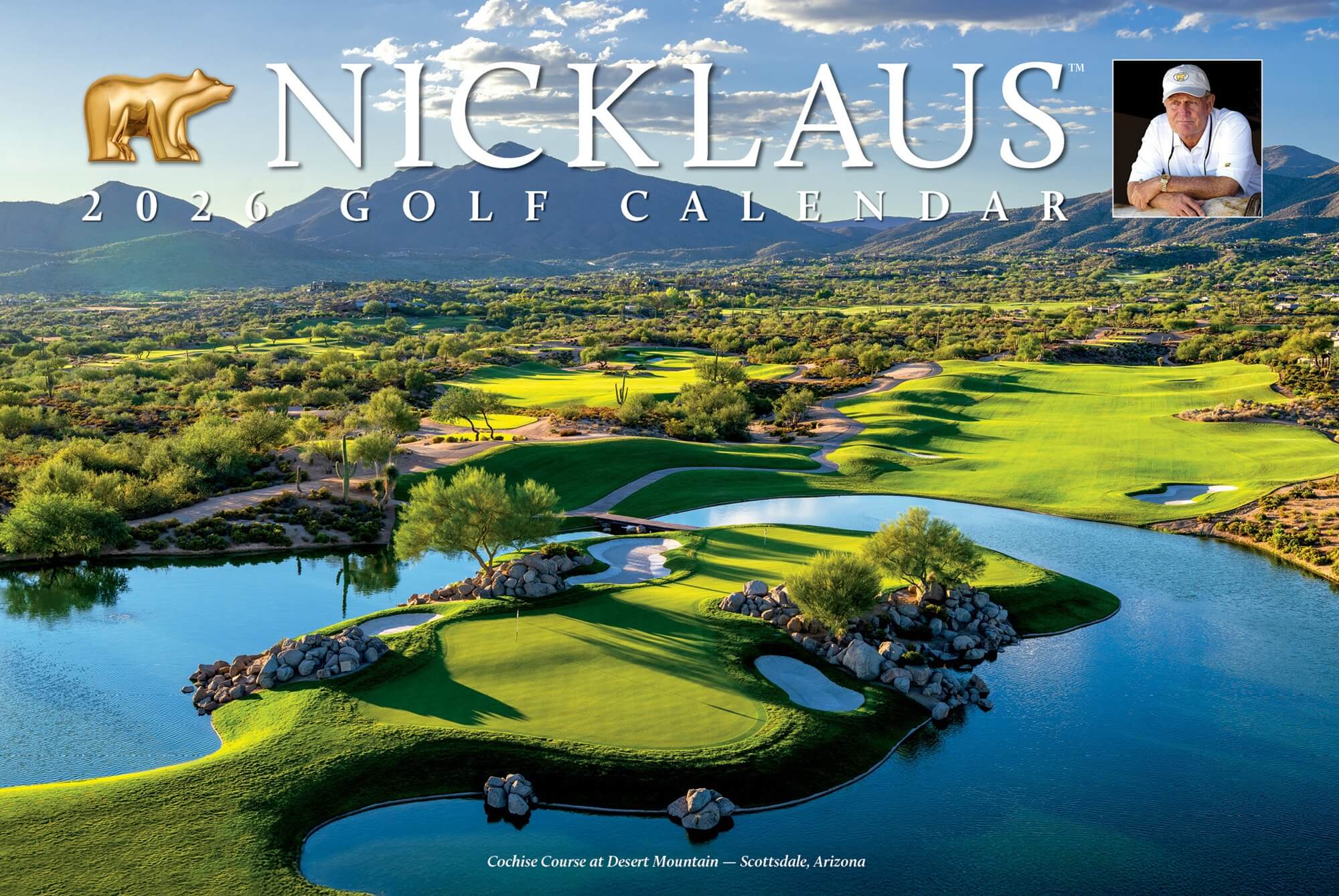

More importantly, it represents the commercial side of Jack’s legacy. Basically, anything you can buy with Jack’s name, image or likeness on it comes from the Nicklaus Companies. This includes everything from Jack Nicklaus wines and calendars to Jack Nicklaus heads, apparel and golf balls. Partnerships using the Jack name with companies such as Vice Golf and Stix are also under the purview of the Nicklaus Companies.

The Nicklaus Companies began in 1970 as Golden Bear International, an umbrella for Jack’s growing off-course ventures. It included his golf course design business, licensing and endorsements, golf instruction centers and non-golf businesses such as oil development and radio broadcasting.

In the early 80s, Jack purchased a controlling interest in MacGregor but an ill-fated development plan at the historic St. Andrews Country in Yonkers, NY, left the company overstretched and close to bankruptcy. Nicklaus was forced to sell MacGregor to save his development company.

In 2007, Nicklaus Companies was officially established through a $145 million deal between Jack and financier Howard Millstein. This new entity was created to expand the Nicklaus brand globally, particularly through the development of international golf courses and real estate development.

This is the company that Jack himself sued this year for defamation.

Why the lawsuit?

By 2017, tensions were building between Nicklaus and Millstein, particularly over control of branding rights and course design. With Millstein taking a stronger role in management, Jack stepped down from his executive role that year. The resignation triggered a five-year non-compete agreement that prevented Jack from designing golf courses, endorsing products or using his name in any commercial venture.

In 2022, as the non-compete was ending, Nicklaus wanted court confirmation to use his name again. The Nicklaus Companies immediately sued Jack to prevent this from happening. A New York judge dismissed the suit this year.

Not long after that dismissal, Jack filed his defamation suit against the Nicklaus Companies. The lawsuit alleged that Nicklaus Companies executives spread false stories to associates and the media, alleging that Jack secretly negotiated a $750 million deal with LIV Golf. The lawsuit further alleged that the company was also spreading stories that the 85-year-old Nicklaus was mentally incompetent, suffering from dementia and unable to manage his own affairs.

Last month, a Florida jury found that Nicklaus’ companies had “actively participated in the false publication of facts” that exposed Nicklaus to ridicule, disbelief and contempt. The jury awarded Jack $50 million in damages.

Why File Bankruptcy?

The verdict and damages proved to be a fatal blow to Nicklaus Companies. Various sources report that the company was already facing $500 to $1 billion in liabilities, against only $10 to $50 million in assets.

It was against those numbers that Nicklaus Companies on Friday filed for Voluntary Chapter 11 bankruptcy in Delaware. IN a statement published on its websitethe company says the filing will allow it to “proactively address its long-term funded debt” as well as the lawsuit settlement.

The statement also said the company disputes the Florida court’s decision and is considering its legal options and a possible appeal. In the meantime, the plan is to restructure the debt while continuing operations. According to the statement, employees and customers of Nicklaus Companies “can be assured that business operations will continue as usual during the restructuring process.”

What does this mean for Jack and the Nicklaus Companies?

Pending the appeal and bankruptcy resolution (which could affect the settlement), that’s $50 million in Jack’s pocket. For the Nicklaus companies, the outcome is less certain.

The liability-to-asset imbalance indicates that the company was already in trouble. Chapter 11 bankruptcy allows a company to continue operating while it reorganizes its debts (Chapter 7 bankruptcy requires the liquidation of its assets). The company says it has secured funding to continue operations for the foreseeable future, but is losing a high-profile defamation lawsuit Jack-freaking-Nicklaus it does him no favors.

In addition, the filing for bankruptcy protection means that the Nicklaus Companies can PROVISIONALLY continue to operate. Survival, however, depends on long-term financing and the settlement of the $50 million owed to Jack. Chapter 11 will give the company time to appeal and delay payment of that decision.

Meanwhile, Jack can design golf courses using his name. Ironically, he cannot use his Golden Bear logo, which still belongs to the Nicklaus Companies.

Post Nicklaus Companies File for Bankruptcy. What does it mean? appeared first on MyGolfSpy.