This week’s news that Golf Lab is being sold For the private capital firm L.Catteron certainly came as a friend.

However, with a little thought and a little touch of business understanding, it should not surprise. Owner and CEO Sam Hahn and his management team had received Laborator as far as they could themselves. To bring the company where they believed they could go, they needed a partner.

Decision on a partner with (while selling interest control for) a private capital firm, however, raises questions and more than some concerns.

We had that chance to ask Hahn for those questions and those concerns. As you will expect, Hahn was honest and not filtered. Here’s what he has to say.

Why sell Golf Laboratory in private capital?

“I was strongly against the idea of working with private capital,” tells Hahn Mygolfspy. “I had the same predetermined notion for them all do.”

You know those predetermined notions. PE always destroys companies. They reduce costs, destroy quality and raise prices only to maximize profit before selling the incompetent body with a profit.

“The trial phase with L. Catterton resembled working with a person of high net value or a proper investor who wanted to be harassed about a business. They were all for business growth.”

This, says Hahn, was in direct contrast to the other PE firms with which he met.

“They were as non -pressing as you would imagine. L. Catterton was the only company that set foot in our building and did not mention the rolling and exit within the first 20 minutes of being here. This is what everyone else did. They went straight to the place where we could cut costs and who would be the other buyer.”

L. Catterton is the world’s largest firm of consumer -focused private capital, with over $ 37 billion in management asset.

“You don’t focus on the exit, focus on the product and the brand,” Hahn says. “This is what sold me to those boys. Combine it with the resources they have, not only financial, but the accelerators they have access, is just outside the tables.”

Laboratory Golf Management team is staying in

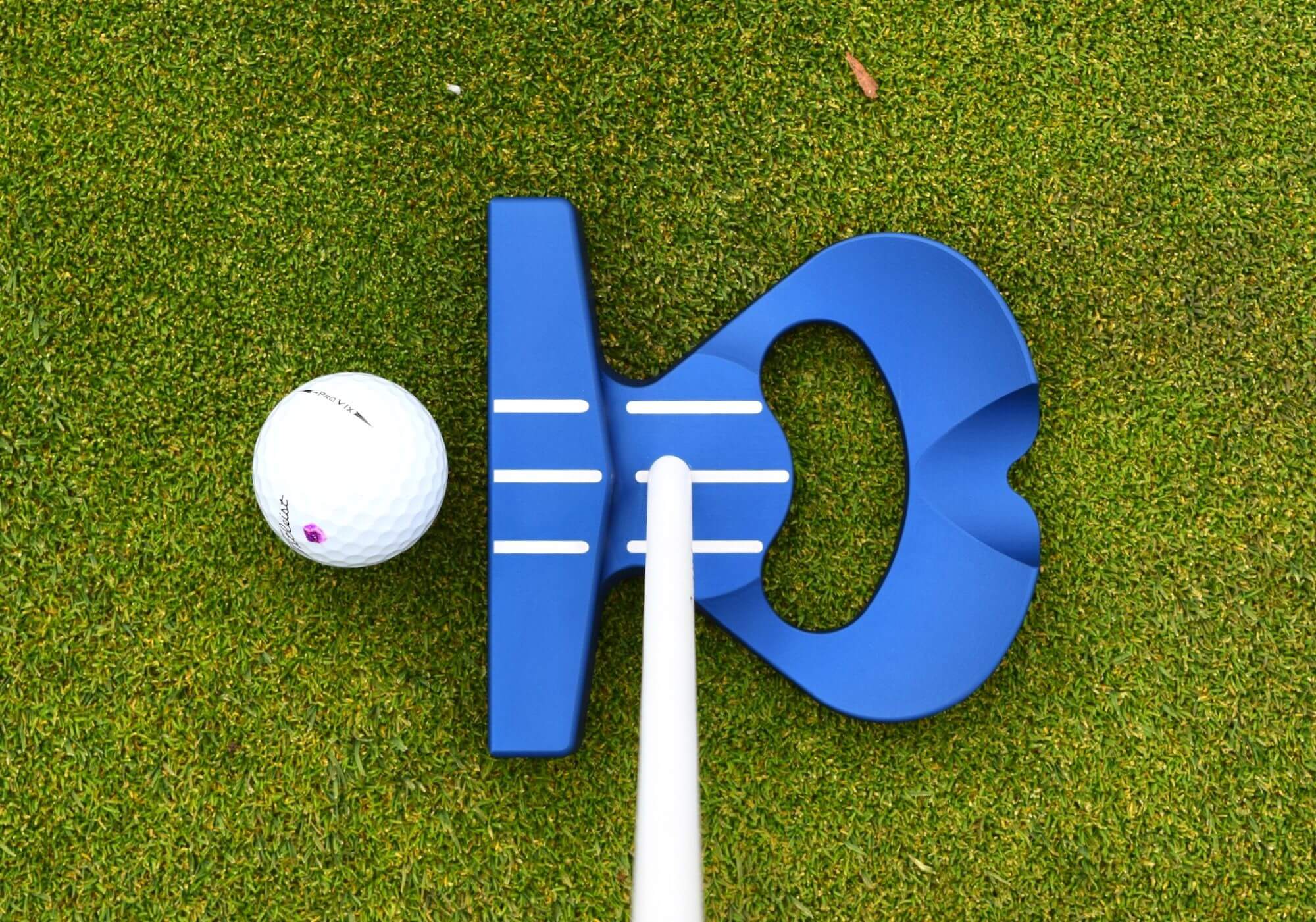

Laborator – Transaction L. Catterson is considered the largest that includes a company set in the history of golf, exceeding Odyssey Putters from the Tommy Armor ownership group. The sale set the Lab golf in $ 200 million, and L. Catterson won a majority.

“Yes, I have a few dollars. Its’ it’s a lot of life -changing money,” Hahn says. “But they have finished me very well and they went to great lengths to ensure that the existing management team would stay. They were not willing to make the deal if we refused to stay further to make sure we could execute our vision.

“This is ultimately what they are buying: our vision.”

Lab currently hires 230 people at its headquarters in Oregon, but admits that the leadership team was a kind of its creation as they continued.

“One of the things that is so special about Lab Golf is that this is a beautiful group of people. We have no real professionalism and of course there is no knowledge of the golf industry. That is why we were able to challenge industry standards on how to run a golf company.

“We came to a point where we have to combine that raw, passionate vibe that the team here in Lab has some business knowledge.”

Lab sold about 130,000 putters in 2024. The company is currently at the pace to triple that number. The problem is within the company’s current framework that the rhythm was unstable, never increased.

“Our executive team was three and a half people,” says Hahn. “There is only so much time a day. Now, with the talent we will be able to bring, business functionality will improve.”

What changes will customers see?

In the short term, players will not see many changes, if there is, in nothing. The first purpose of new ownership is to support the end of the business.

“Our retailers will be the first to see improvements based on the professionalism we intend to implement,” explains Hahn. “Lead times will start to go down, the quality will increase, and the issues related to the service will be treated much faster. We will set some team members who have made this type of items before.”

Lead times have become a particularly sharp issue as Laborator has grown. Recently just two years ago, Lab Putters were a wonder. Adam Scott was the first pro -note Tour to bring one, but the growth he was building was released when Lucas Glover placed a lab in his bag and won two tournaments in 2023.

“It was no doubt Lucas, but it’s also all the people on YouTube who received an attack of their will and started using them,” Hahn says. “But more than anything alone, it’s the critical measure of the boys in your club they are doing better.”

Since then, Hahn says the biggest business accelerator has been competition.

“When we began to see copies appear last November, we were really nervous. But by January, it was clear that competition was a good thing. Everyone was proven our technology. Since we are much farther away from our development, many people rightly and wisely chose to go with OG.

“Our clients have been so patient with us, through issues of supply chain, transport issues and customer service issues. It is time for us to grow and serve the client, and customers have served us.”

What about Internet feedback?

Reaction to social media to Laborator The sale has been mixed. So far, the biggest negative answer has been selling to private capital, the fear that new ownership will execute Lab on the field for a quick profit. Many seem to be taking the sale personally, something that Hahn can understand.

“I get it completely. I have complete compassion for their concerns,” he says. “As for me, our clients own this company. They have made our promotion for us, and they are why we are where we are.

“So in a roundabout way, we just went and sold their business without talking to them.”

Hahn remained responding late by responding to those comments.

“I was sad, wishing the trust I had created in person and we had founded it as a company that would say something at the moment, but I understand it didn’t.

“(L. Catterton) It’s everything so passionate about this brand as we are. I’m prepared to get some shit here for a while, and I get it completely. But not all PE transactions are bad and not all PE companies are just interested in a quick lid.”

The reality is that without this transaction, Lab would not be able to continue on the road where it was. The challenge was greater than just “getting new investors”.

“The decisions you need to make in order to continue to grow how simply plateau is multi-million-dollar decisions,” says Hahn. “It took us eight years to build the operation we have here. You can’t catch your fingers and open construction stores around the world to serve our global clients. We need time, we need talent and we need money to accomplish everything. It was a simple inevitability.”

The new reality of the laboratory golf

Sale closes chapter one of Laborator History while Hahn is setting a positive rotation in Chapter Two, he admits that there is a lot of uncertainty.

“I will not lie. I too am scared,” he admits. “I have the same fear as the rest of the world. I’m less scared with L. Catterton than I was with anyone else but you still don’t know.”

One thing that made Hahn less scared of L. Catterton was that he seemed to understand the importance of ping.

“What I introduced to L. Catterton and what they seemed to understand was that the longer you can maintain the vision and values led by the founder, the better your company will be. Ping is the best example. That is why they have managed to stay so clean. Those essential values have never changed.”

If there is a warning tale, it is that of the original Rife Putter company. Guerin Rife began its company in 2000, armed with patented technology and a healthy dose of self -esteem similar to Hahn. Rife 2-bar soon became a mini-blocker. By 2008, Rife was an underground success of $ 10 million. However, to promote that growth, Rife had given up parts of ownership for investors. He eventually lost control of the company that gave birth to his name.

“I admit I can be stupid,” Hahn admits. “In two years there may be someone who says everyone was right, but I don’t believe in my bones. I feel we’ve made the right decision. And just like Lab Golf has done everything in our own way, I think we can make our way.

“I hope people do not write to us very soon and that we have the opportunity to show them that this transaction may have gave birth to a single more innovative entity in Golf.”

office Sam Hahn tells why the laboratories sold golf first appeared in MygolfSSS.